24 |

Oilfield Technology

June

2015

in order to be seen as an attractive solution in the future. Subsea

processing alternatives will be held up against other concepts

(traditional SPS, topside solutions) when evaluating the most

profitable business case for a development.

Simply put, the benefits of investing in subsea processing can be

explained through two cases:

Ì

Ì

Case 1: Carry out a brownfield implementation and delay the

capex related to subsea processing equipment until it is required,

in order to continue production from the field. The upside is

increased recovery and delayed capex.

Ì

Ì

Case 2: Carry out a greenfield implementation and reduce opex

by shortening the expected lifetime of the field.

These alternatives will be held up against other field

development concepts and the challenge is to create confidence

in the estimated increased recovery as well as the costs related to

investment and operation, to build plausible business cases.

Subsea pumping is becoming more commonplace and the

world’s first subsea compression systems will come on‑stream this

year. Developing these systems has been costly and time‑consuming.

Looking ahead, more efficient project execution can be expected

now that the industry has these experiences onboard, also aided by

standardisation efforts and re‑use of qualified technology.

Seabedsolution

The subsea sector is reportedly set to grow

significantly, going forward. According to recent

outlook reports, within 20 years, subsea production

will be on a par with traditional oil and gas production

offshore. Looking even further ahead, it is anticipated

that subsea will surpass traditional platforms in terms

of production.

Subsea developments have been made possible by

technologies such as flexibles, multiphase flow, subsea

trees and umbilicals. Subsea processing, however, has

had a slower implementation than earlier forecasts.

Its development, however, will have the potential

to remodel offshore developments globally through

subsea separation, re‑injection and boosting.

Investment and innovation in subsea processing

will be driven by the cost‑efficiencies it delivers.

Today, subsea processing has mainly been used

for increasing production in mature and marginal

fields. In the future, the experiences gained in this

area can be used to take this technology into harsh

environments where processing equipment located

on the surface might be at risk.

Standardsbenefit technology

Within the subsea market, it has typically been the

case that suppliers have responded to the needs

of the customer. At the same time, innovation and

standardisation have a long tradition of being

developed as collaborative efforts by industry players,

as the volume and maturity of the market segment has

grown. The standards developed are often adapted

by the authorities to form part of a regulatory regime,

where the customer/end user is ultimately held

responsible for adhering to these regulations in the

operation of the supplied technology.

Subsea is, by its nature, a conservative market.

Subsea technology, once installed, does not have the

benefit or option of easy adjustments, due to access

being relatively demanding and expensive. This in turn

drives the requirements for thorough qualification and robustness

of such facilities. Traditionally, each operating company has collated

its experiences and best practices into company specific technical

requirements. Facing the supply chain, where each operating

company interfaces with various contractors, who again interface

with various sub‑suppliers, the number of requirements down the

supplier hierarchy becomes relatively complex, and with it the

manufacturing and quality cost grow.

DNV GL is a firm believer that ingenious standardisation will

provide predictability in the supply chain, with respect to design,

manufacture and operation of technology. This predictability

through such standardisation still allows for flexibility to create

bespoke facilities at a system level through configuration of

standard building blocks or modules at a lower level. Standardising

at the right level will allow suppliers to optimise their processes and

products and promote efficiency in cost and quality.

A study published on standardisation by DIN German Institute

(Economic benefits of standardisation, DIN German Institute for

Standardization e. V.) discovered that there are inherent additional

benefits from standardisation with regards to cost reduction and the

competitive status of companies that participate in such activities

at an early stage. The opportunity to influence the content of the

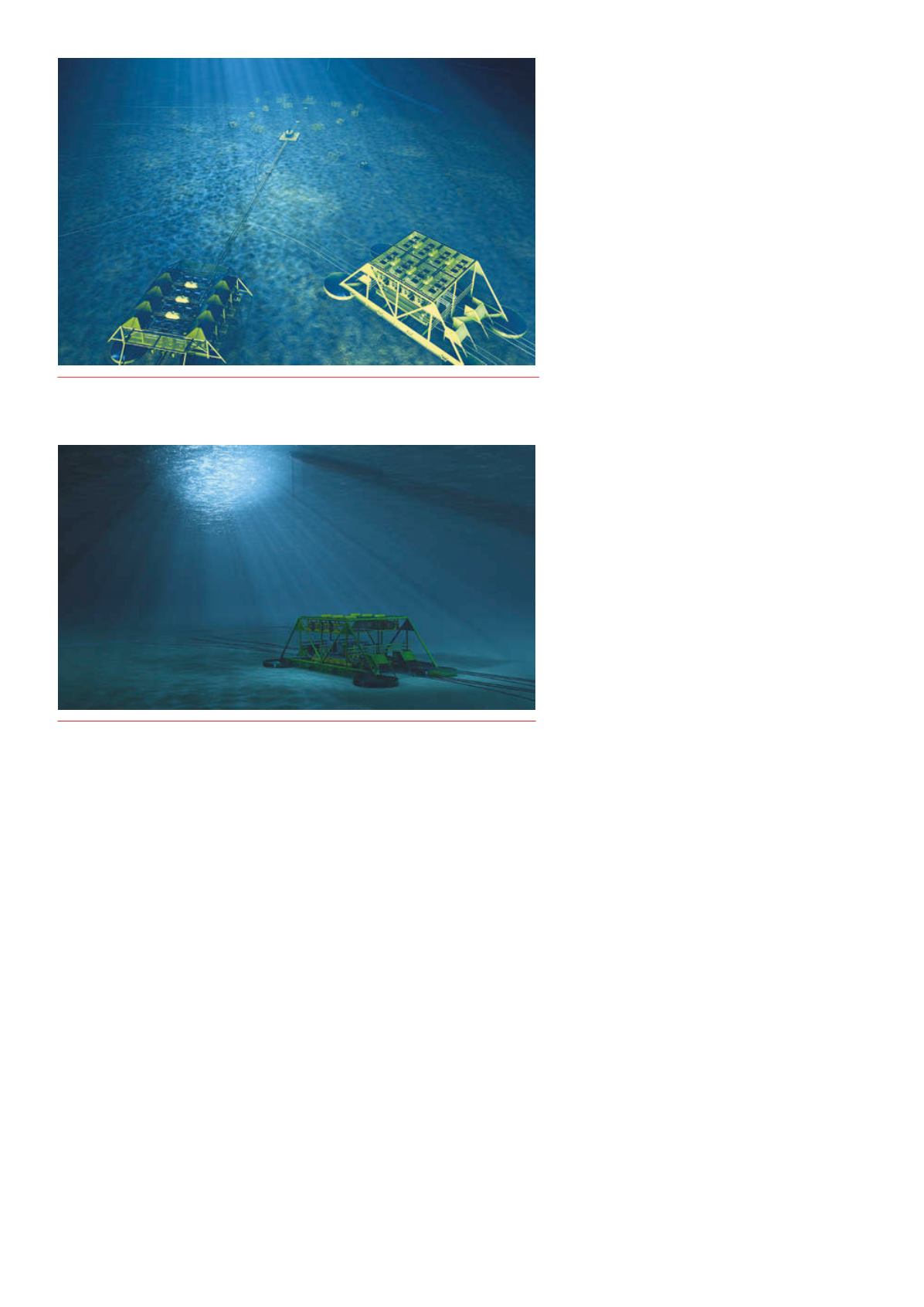

Figure 2.

The oil andgas industry’s drive to developmore cost-efficient ways to produce,

process and transport oil andgas offshore has in recent years led to tremendous technology

developments on subsea technology.

Figure 3.

Subsea is, by its nature, a conservativemarket. Subsea technology, once

installed, does not have the benefit or option of easy adjustments, due to access being

relatively demandingand expensive. This in turndrives the requirements for thorough

qualificationand robustness of such facilities.