HYDROCARBON

ENGINEERING

66

value added resellers. However, established solution

providers have started to develop mainstream

solutions for this market. Industry experience and

ability to deliver solutions for a variety of product

grades will decide who leads the market over the

next 2 - 3 years.

Best practices

As rail based hydrocarbon transportation is here to

stay, some of the best practices to be pursued in this

market are:

n

Deployment of fleet management best practices

for rail management.

n

Integration of rail loading and unloading

operations at the terminal using components

such as real time location sensing (RTLS), global

positioning satellites (GPS), ocular character

recognition (OCR) and radio frequency

identification (RFID).

n

Real time data visibility and asset optimisation

to meet the growing demand.

New service requirements will be another growth

opportunity for solution providers. As the ageing

workforce continues to be an issue, end users are

looking to automate their operations end to end in

order to maintain operational excellence. A case in

point is the need for integration services to connect

multiple terminals that are currently managed by

disparate functions and systems. Another example is

the need to centralise alarm management across

terminals. These are real customer needs that Frost &

Sullivan obtained from user interactions.

Summing up, holistic offerings from solution

providers are the need for the day.

Three big predictions for

the next five years

n

Low cost feedstock derivative will impact

industrial markets will create extensive

brownfield opportunities for modernisation,

capacity expansion and retrofit addition to

existing infrastructure.

n

The software and services product segments will

witness the highest growth during the forecast

period as end users look for application specific

tools such as loading automation and order

management software to optimise

terminal operations and after sales

support to minimise downtime.

n

Infrastructure investments in

pipelines and rail networks to

transport the abundant oil and gas

produced in North America will

create new terminal automation

opportunities for solution providers,

particularly in the area of rail

management software which can

provide real time data streams on

product identification, location and

performance.

T&T

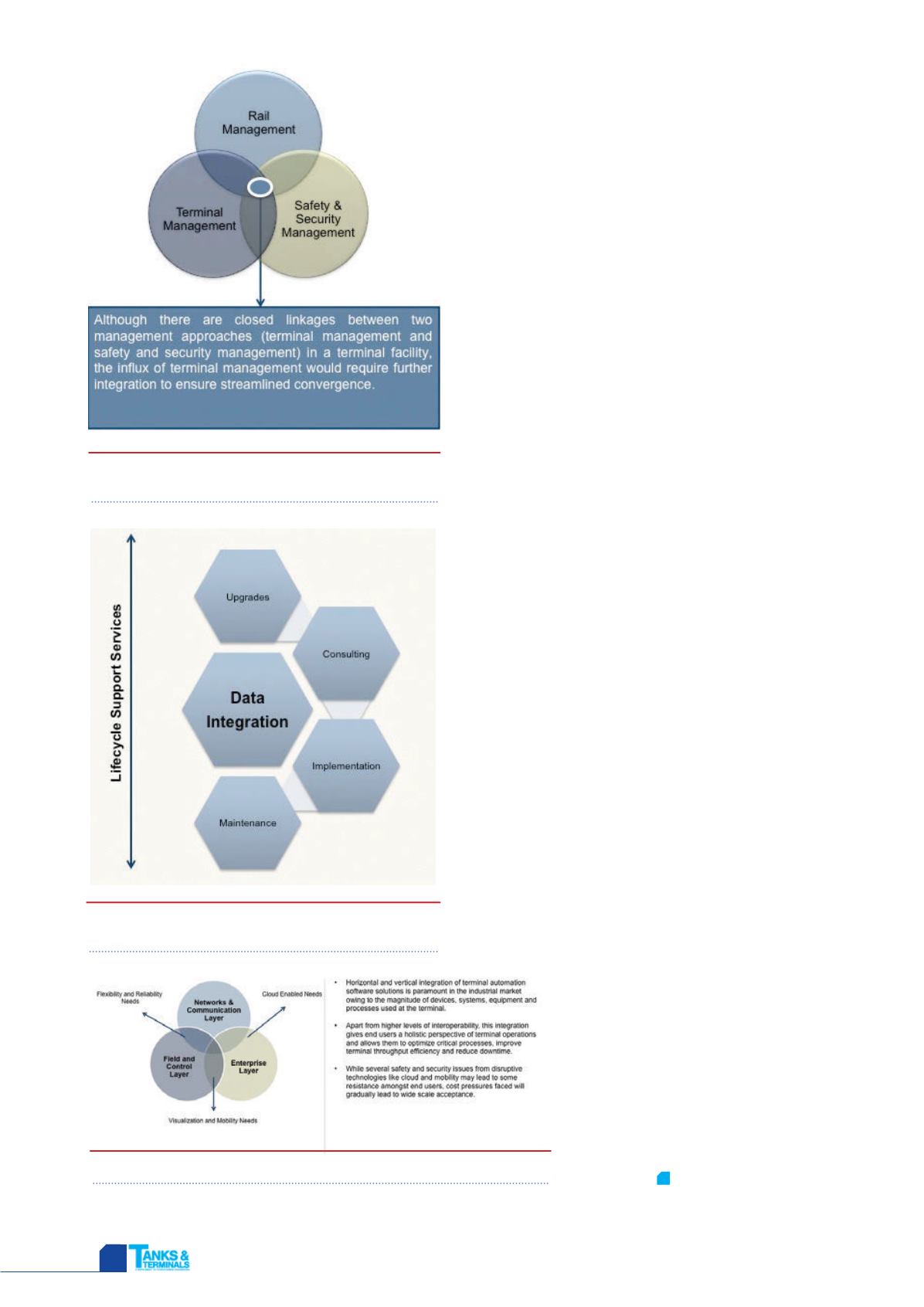

Figure 4.

Opportunities from rail infrastructure

investment.

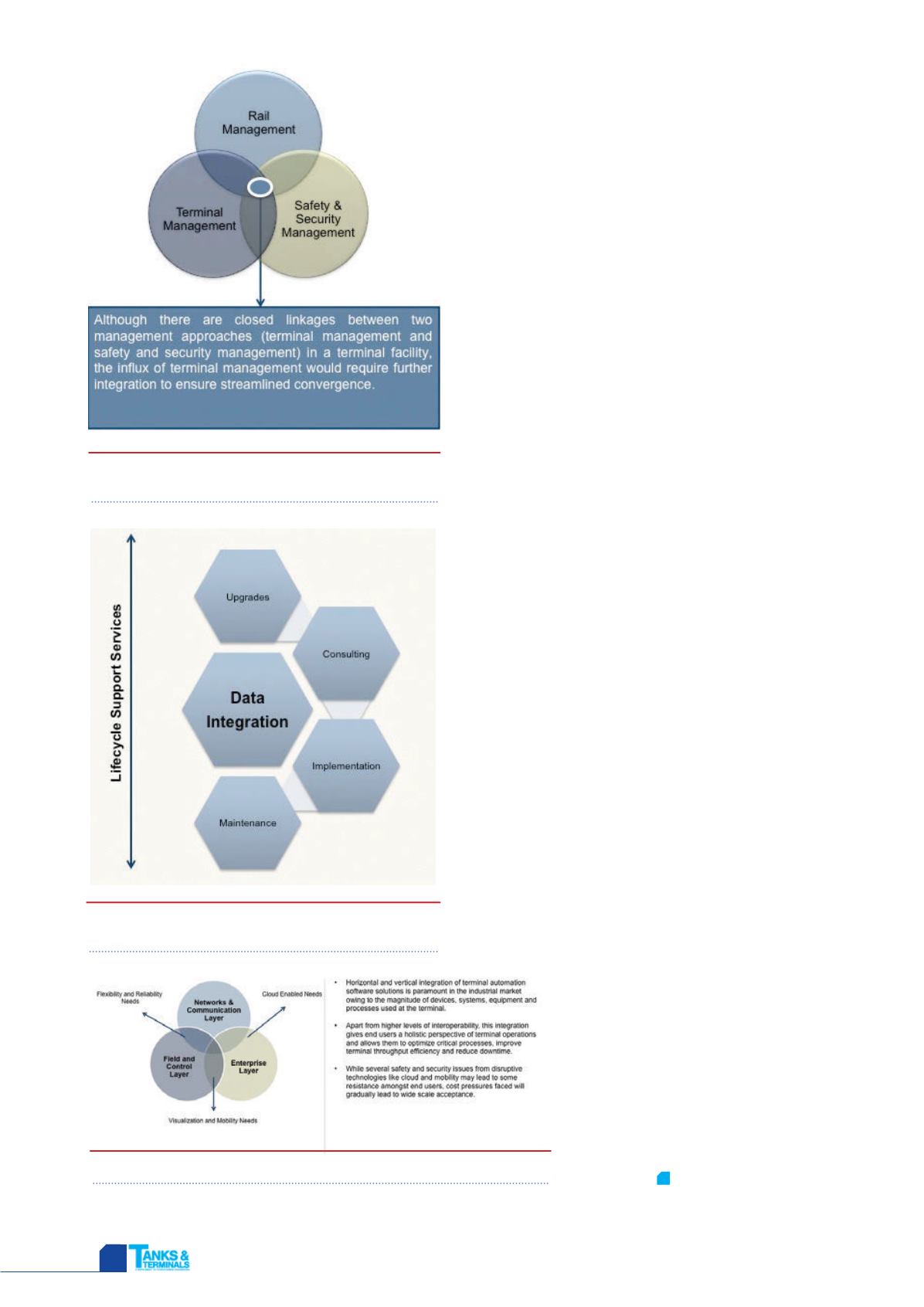

Figure 5.

New service requirements: data

integration.

Figure 6.

Requirements of a holistic solution offering.