modernisation. Unlike other segments in the

region’s oil and gas value chain, which saw growth

in excess of 9.0%, terminal automation has lagged

due to end user inability to clearly see the

business case for automation. One of the key

trends driving a tectonic shift in implementation

cases is the integration of terminal controls with

business applications. The need for operational

excellence, especially in the face of declining

skilled workforce availability, is expected to drive

modernisation related investments in the market.

The future of the terminal

automation market can be

assessed through several unique

perspectives such as CEO’s,

market, competitive and best

practices.

CEO’s

perspective

Frost & Sullivan has devised a

holistic model that critically

looks at seven unique

perspectives instrumental to

reduced performance

variability.

Market

perspective

Shale gas investments

and production

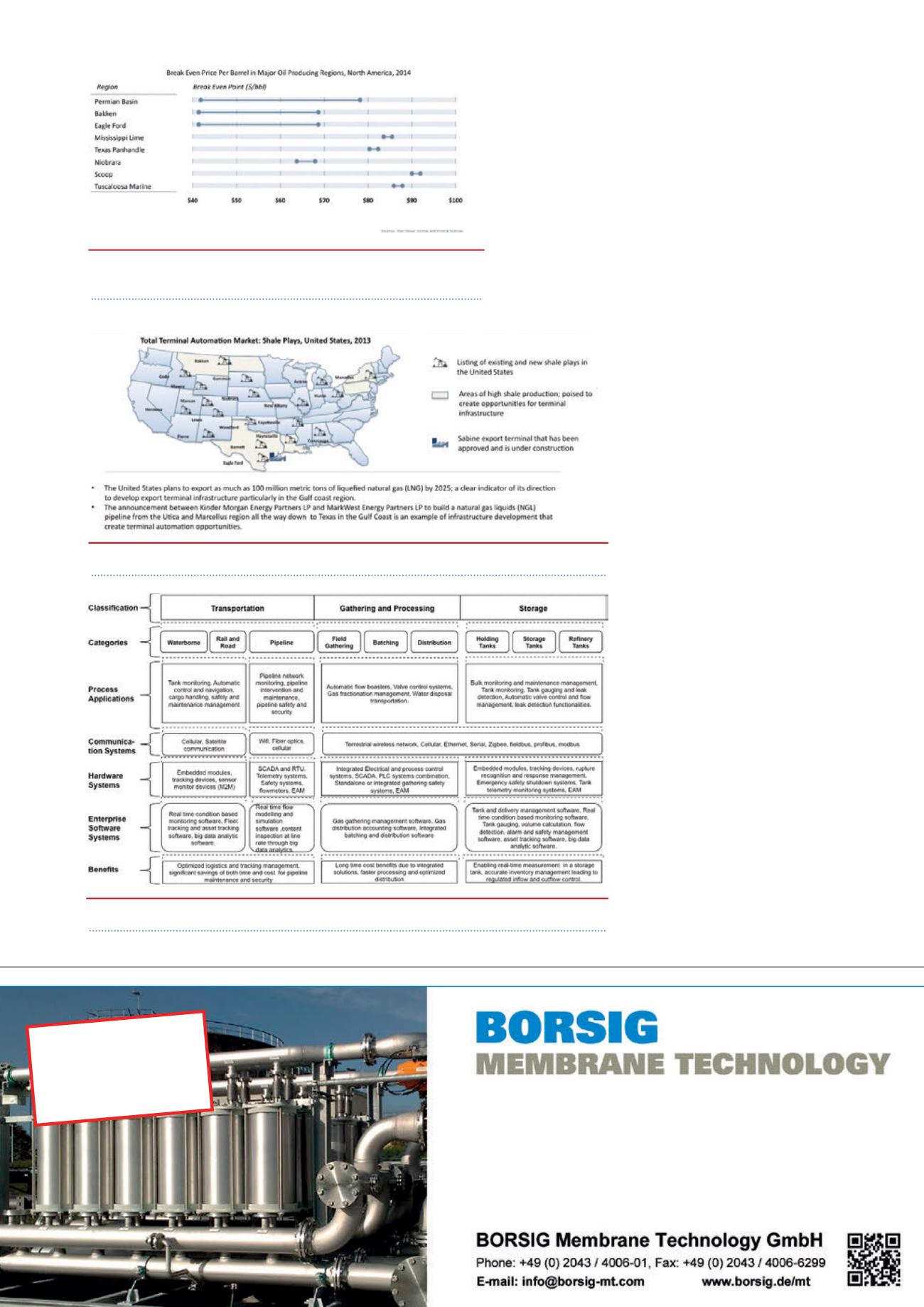

Although, oil prices have taken

a dip below US$70 /bbl (as of

8 December 2014), the US is not

expected to stop ongoing

production. The breakeven

price for US shale production

ranges from US$50 to over

US$100, as shown in Figure 1.

Hence, even at current prices,

there are promising margins for

cost effective production.

Poor connectivity between

existing shale plays and

StocExpo Europe

Tank World Expo

ACHEMA 2015

Tank Storage Asia

Emission Control

Product Recovery

BORSIG

Vapour Recovery Unit

BORSIG

Ethylene Recovery Unit

BORSIG

Carbon Retrofit Unit

BORSIG

Propylene Recovery Unit

BORSIG

Vent Recovery Unit

BORSIG

Nitrogen Recovery Unit

BORSIG

Hydrocarbon Recovery Unit

BORSIG

Organic Solvent Nanofiltration

Gas Separation

Engineering/Services

Figure 1.

North American oil production. Break even

point per region.

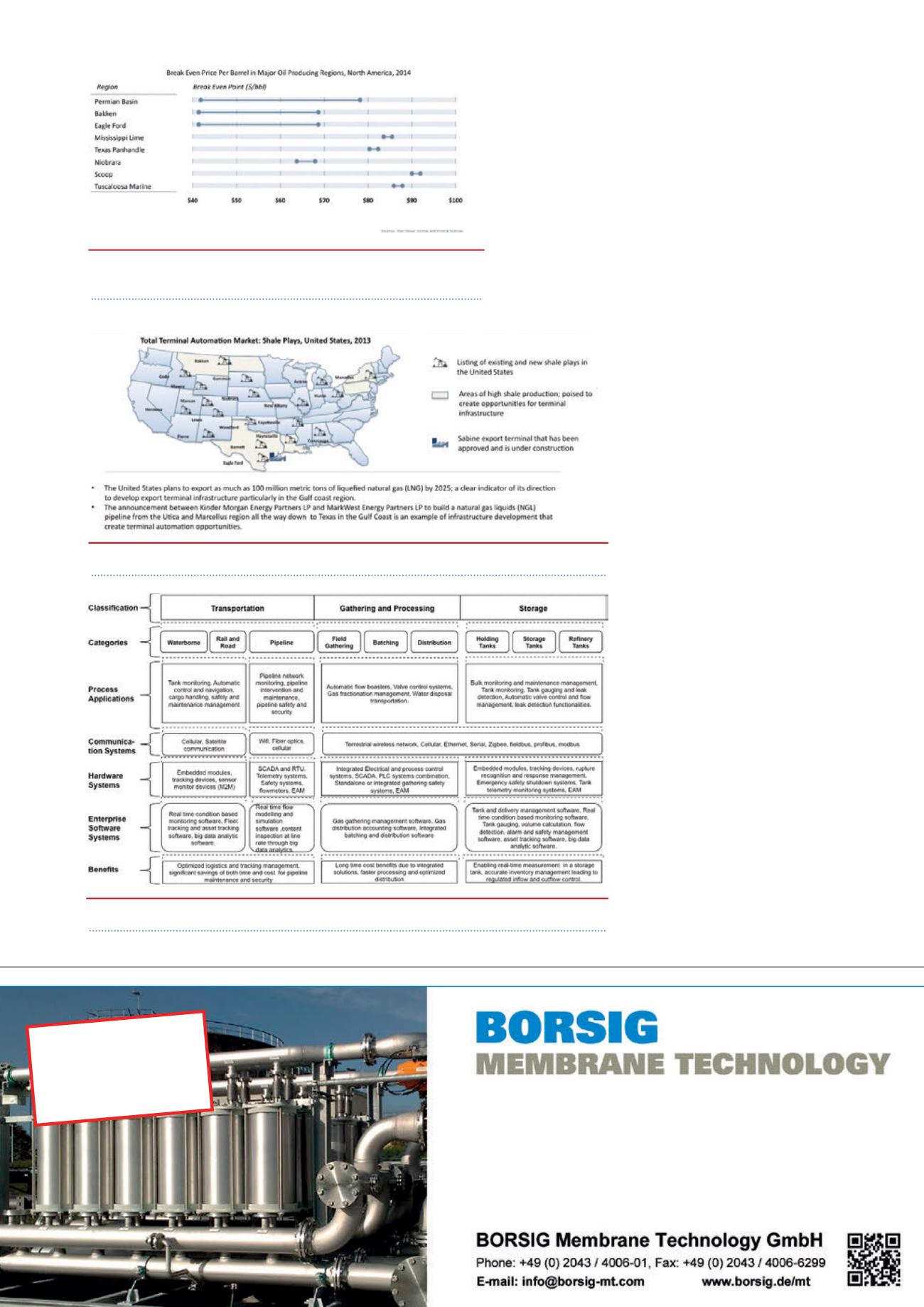

Figure 2.

Opportunity mapping, the US.

Figure 3.

Midstream automation value chain mapping.