producers to store as much as 100 million bbls of their crude

oil in different locations across India. It is also looking to admit

private local and foreign participation in the development of

storage facilities under a second phase programme costing

200 billion rupees. (US$1 = 62 rupees).

Indian Strategic Petroleum Reserves Ltd (ISPRL), the state

agency overseeing the stockpiling programme, expects to

complete the first phase of three underground terminals by late

2015.

It will begin by filling up the first storage terminal in the

city port of Visakhapatnam in Andhra Pradesh state that was

constructed in February. The petroleum ministry is in talks with

Iraq to import crude to fill the Visakhapatnam underground cavern

which has the capacity to hold up to 1.33 million t. The other

two caverns at Padur (2.5 million t) and Mangalore (1.5 million t) in

Karnataka state are due for completion later in the year.

With a budget of just 24 billion rupees or US$387 million to

procure crude for the stockpile, ISPRL expects to seek private

funding to help fill up the three terminals’ combined storage

capacity of 5.33 million t or nearly 40 million bbls. At the current

crude price of US$60/bbl, the agency would need around

US$2.4 billion to fill up the three storage caverns to meet 10 days

of national consumption.

ISPRL has estimated that it will need an annual budget of

17.9 billion rupees to operate and maintain the three caverns. New

Delhi, which will cover the cost of security, is planning to build

another four caverns with a total capacity of 12.5 million t.

To partly offset the programme’s high cost, the government

has offered to store crude for Saudi Arabia, Kuwait and Abu Dhabi.

Japan and South Korea lead in this co-storing strategy, which gives

them first access to crude in the event of supply disruptions.

India announced plans to develop its strategic stockpile

programme in 2009, but failed repeatedly to meet deadlines on

account of bureaucratic infighting, red-tape and the high cost of

procuring crude when Brent traded at an average cost of US$100

and US$110 a barrel between 2010 - 2013.

Gujarat state to add two LNG terminals, Odisha

‘loses’ proposed floating unit

Gujarat state is consolidating its status as the country’s main

energy hub with plans to add two LNG import terminals to its

existing 15 million tpy capacity.

To meet rising energy demand in the state and surrounding

area, chief minister Anandiben Patel said her government is

working with investors to set up a 5 million terminal near Jafrabad

in Amreli district and another at Mundra port in Kutch district by

2017.

State-owned gas importer Petronet has affirmed plans

to expand its 10 million t terminal at Dahej to 15 million t by

end-2016 while the Shell-Total joint venture may add to its

5 million t terminal at Hazira once Shell completes its takeover of

BG.

Ms Patel, who also oversees Gujarat’s port development,

recently told the state assembly that the Mumbai-listed Swan

Energy Ltd has been awarded a contract to develop and operate a

floating storage and re-gassification unit (FSRU) in Jafrabad facing

the Arabian Sea. Separately, Adani Group and state-owned Gujarat

State Petroleum Corporation (GSPC) have agreed to jointly

develop a land-based terminal at Mundra.

In addition to the LNG terminals, Gujarat is home

to three large oil refineries with a combined capacity

of more than two million bpd. At 1.4 million bpd in

capacity, the Reliance Industries Ltd plant at Jamnagar is

the world’s largest stand-alone refinery. Essar Oil owns a

400 000 bpd refinery while an IndianOil Corp subsidiary

has a 280 000 bpd plant.

Meanwhile, Gas India Limited (GAIL) has cancelled

plans to build and operate a 4 million t floating LNG

terminal (FLNG) off Paradip port on the east coast state

of Odisha. The company decided not to proceed with

the 300 billion rupee project in favour of a competing

project in nearby Andhra Pradesh state.

India’s other two existing LNG terminals at Dabhol

in Maharashtra state and Kochi in Kerala are operating

below capacity due partly to the lack of pipeline

infrastructure to deliver gas to end-users and the

relatively high cost of imported gas compared with oil.

Due to inadequate pipeline capacity, poor

infrastructure and the fuel’s higher cost, cleaner-

burning natural gas was used to generate just 9% of

India’s electricity last year compared with coal’s 60%

contribution, according to the power ministry.

An inter-ministry government panel has released a

report forecasting India’s gas deficit to nearly double

to 300 million m

2

/d this year from 152 million m

2

/d

in 2012. India will have to increasingly rely on imports

as its domestic gas production is falling on account of

depleting reserves and failure to attract investments

from the industry.

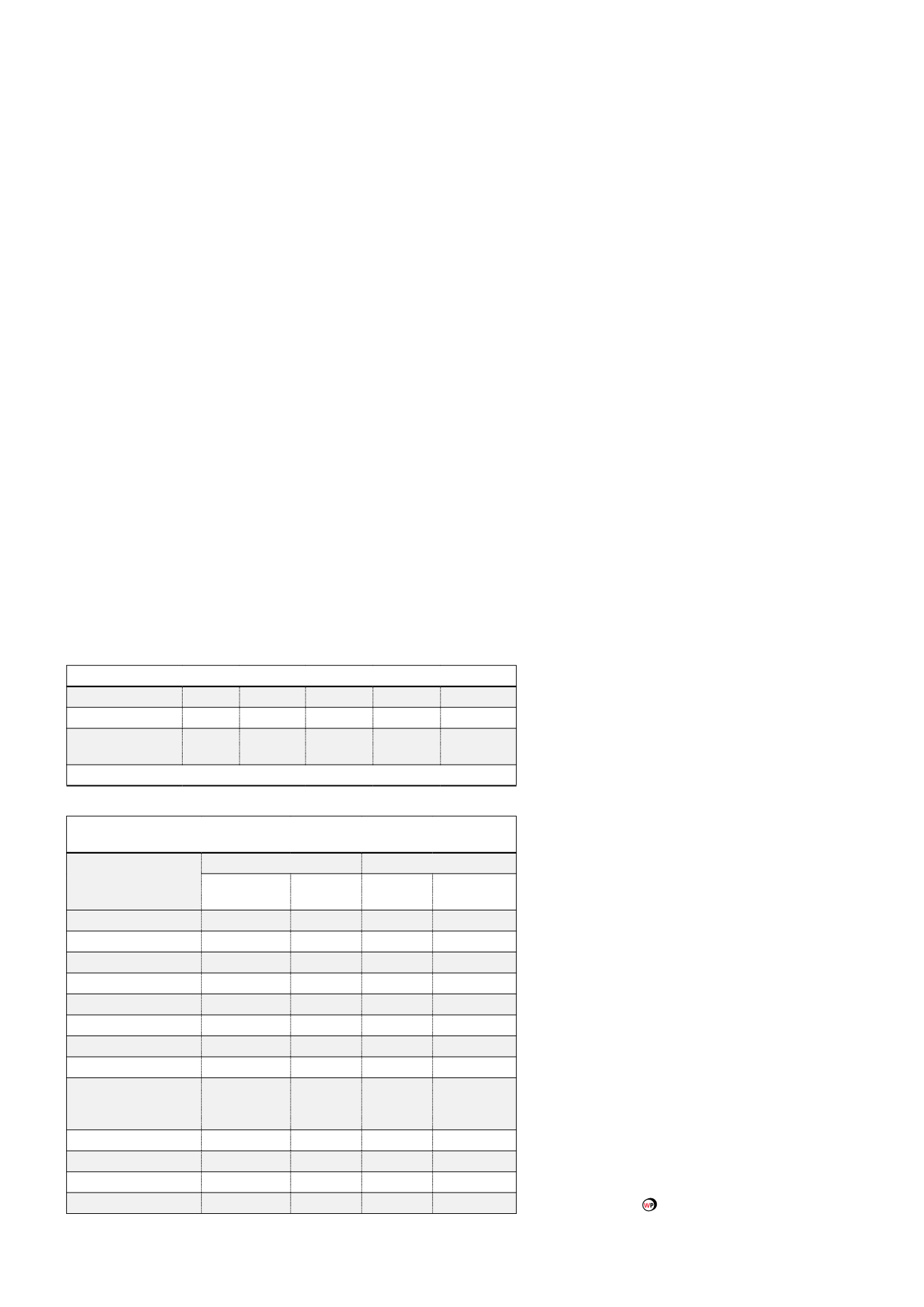

Table 1. IMF: India’s improving economy

2011/12 2012/2013 2013/2014 2014/2015 2015/2016*

GDP growth (%)

6.7

4.5

4.7

7.5

7.5

Government deficit

(% of GDP)

-6

-5.1

-4.8

-4.4

-4.1

*forecast

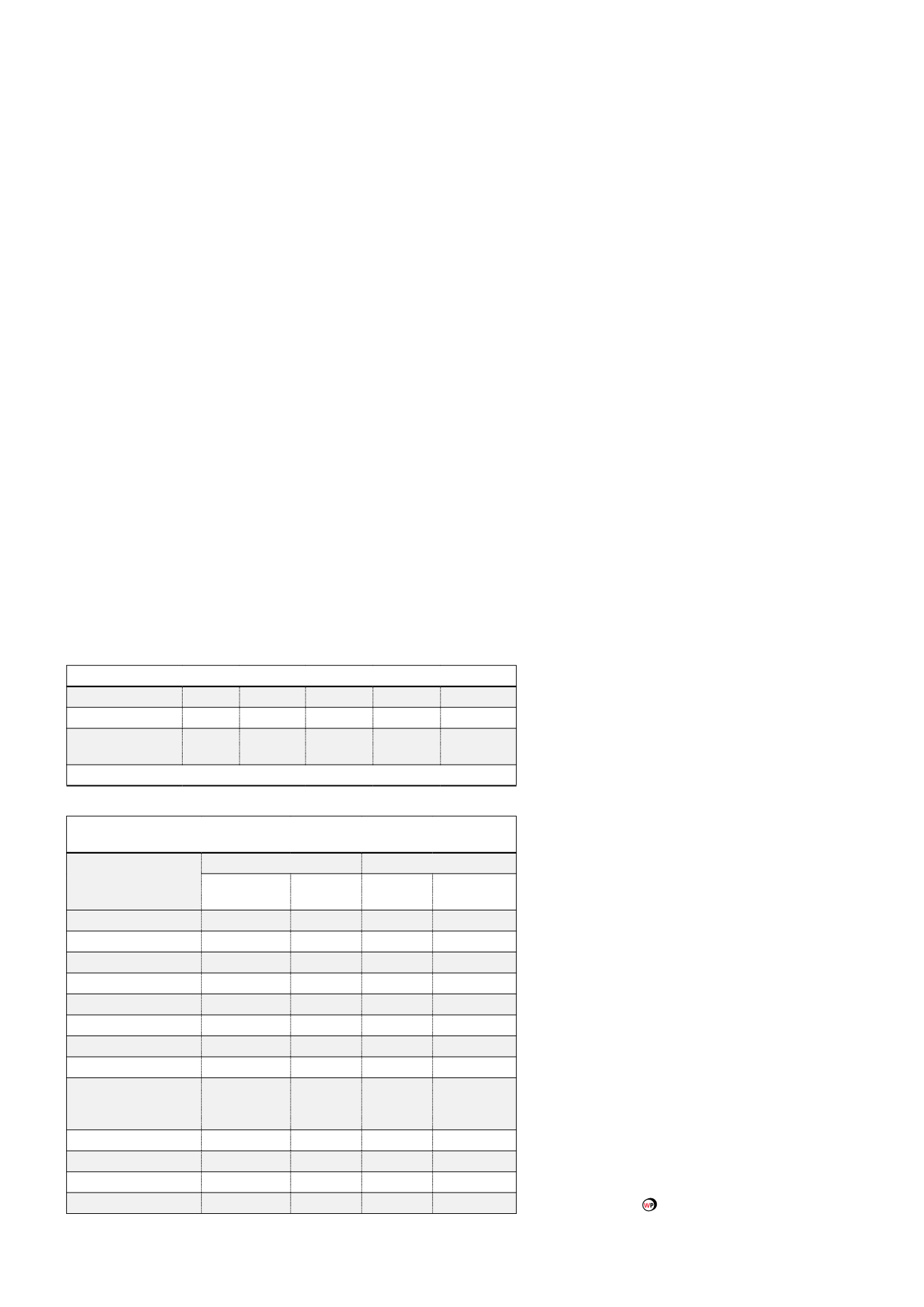

Table 2. India’s oil products consumption, in bpd (

Source: Ministry of

Petroleum & Natural Gas)

Products

FY2014-15

FY2015-16 (forecast)

Estimated

000 bpd

Year/year

growth %

Forecast

000 bpd

Year/year

growth %

LPG

549.707

7.1

568.969

3.50

Motor spirit

423.222

7.4

453.715

7.21

Naphtha

266.489

-4.4

252.246

-5.34

Aviation turbine fuel

121.951

1.1

124.690

2.25

Superior kerosene

153.995

-1.9

148.252

-3.73

High-sulphur diesel

1397.881

0.2

1455.790 4.14

Low sulphur diesel

7.532

-4.5

6.123

-18.70

Lubricants

58.723

-7.4

59.982

2.14

Fuel oil and low

sulphur heavy stock

(LSHS)

100.668

-7.9

95.774

-4.86

Bitumen

82.330

0

84.976

3.21

Petroleum coke

202.620

14.4

214.341

5.78

Others

119.069

4.2

130.349

9.47

TOTAL

3484.185

2

3595.207 3.19

16

World Pipelines

/

JULY 2015