renewable energies, gas demand had dropped from almost

522 billion m

3

in 2010 to 461 billion m

3

in 2013.

3

At the same

time, according to the International Energy Agency (IEA)

Europe’s gas production in 2020 is expected to be 25%

below its 2010 level.

4

As a consequence, EU gas import

requirements are to increase by almost one-third between

2014 and 2020.

5

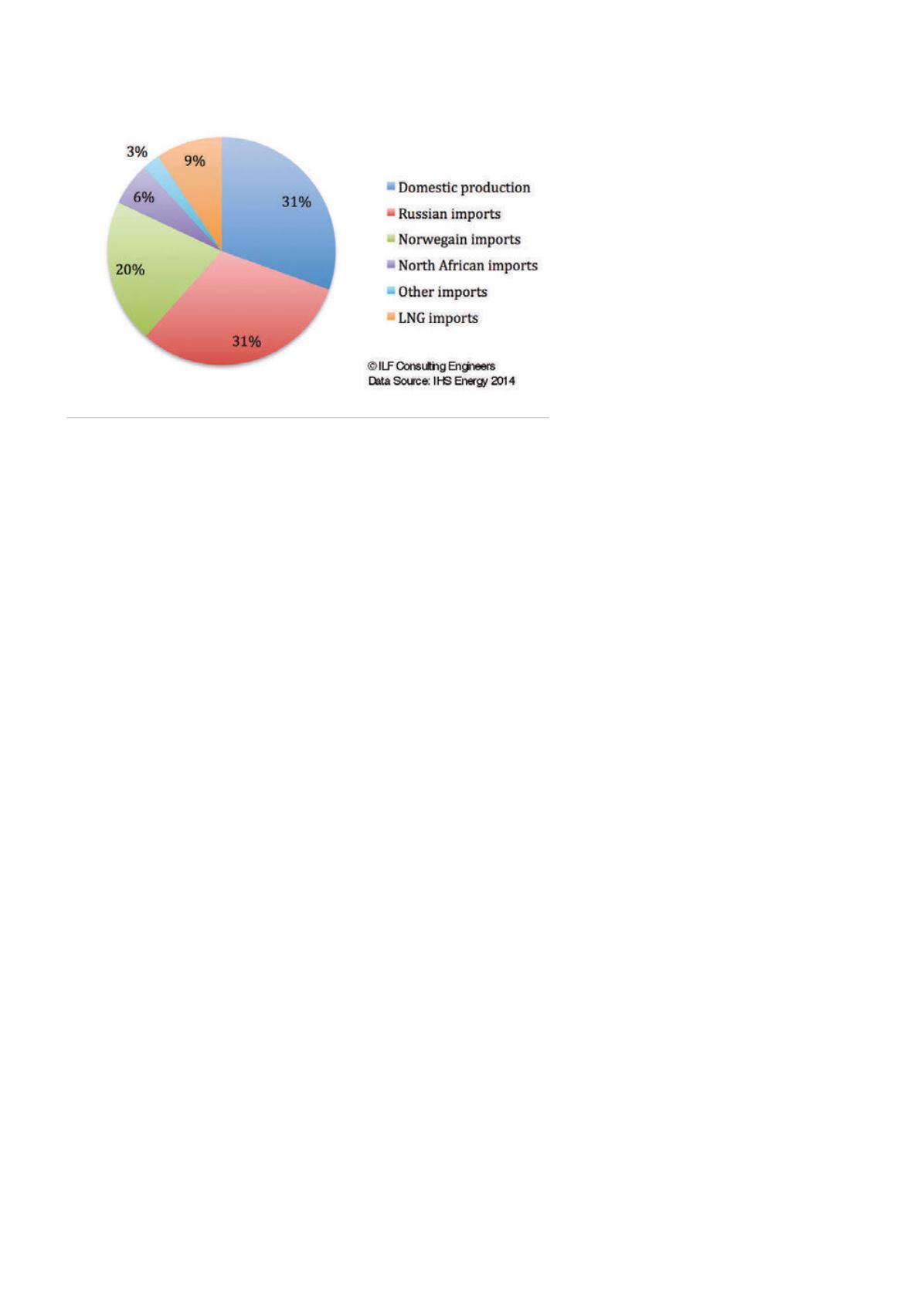

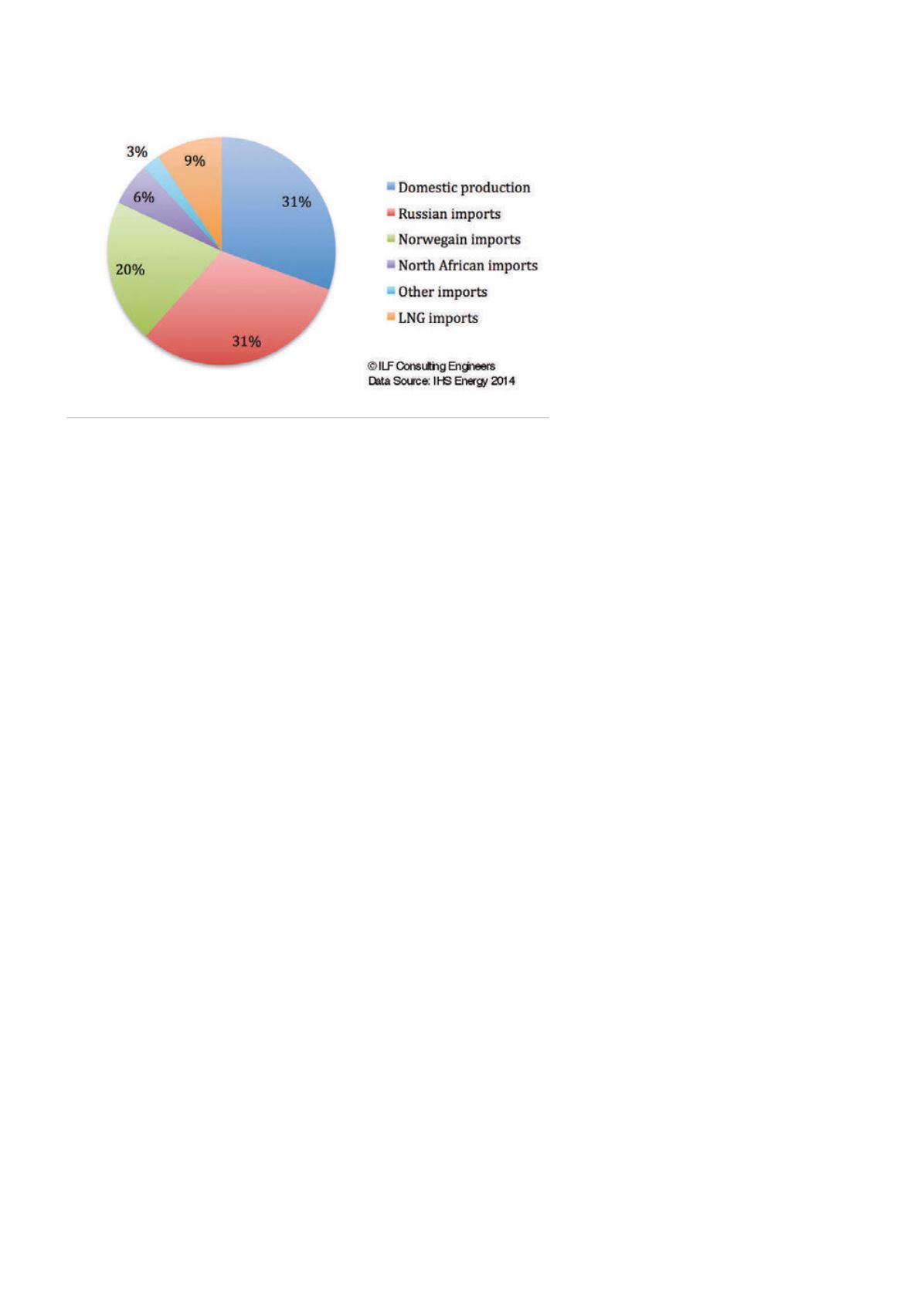

In order to meet EU demand, gas is currently imported

through three large corridors: the eastern corridor from

Russia, the northern corridor from Norway, and the

Mediterranean corridor from Libya and Algeria. In addition,

LNG is imported, with Qatar and Algeria being Europe’s

leading LNG providers. Imports from the US have also

been growing since the shale gas boom.

6

LNG supplies

are expected to further grow over the next five years and

Europe is set to offer an important outlet.

7

The Southern Gas Corridor –

diversification of gas supplies to European

markets

A fourth gas entry route, the Southern Gas Corridor,

carrying Caspian gas and potentially gas from the Middle

East and Central Asia, has been recognised by the EC for

its strategic importance in terms of EU’s energy security.

8

This megaproject, which requires approximately US$45

billion of investment,

9

involves the construction of three

major pipeline sections, in total stretching across 3500

km to provide an export route to Europe for Azerbaijan’s

offshore Shah Deniz 2 gas field in the Caspian Sea: the

South Caucasus Pipeline (SCP), the Trans-Anatolian Gas

Pipeline (TANAP) and Trans-Adriatic Pipeline (TAP). SCP is

already in place, but requires capacity extensions, while

TANAP and TAP are yet to be constructed.

As the main source of supply to the Southern Gas

Corridor, BP’s Shah Deniz 2 gas field will deliver 16 billion

m

3

/yr of gas through the Sangachal Terminal in Baku,

Azerbaijan into the expanded South Caucasus Pipeline

(SCPX), which runs via Tbilisi to Erzurum in Turkey along

the route of the Baku-Tbilisi-Ceyhan (BTC)

crude oil pipeline.

Since 2006, the SCP (692 km, 42 in.) has

been jointly operated by BP and Statoil to

supply markets in Turkey and Georgia. The

current SCPX project involves the looping

of the SCP in Azerbaijan and partially in

Georgia, as well as the construction of

two new compressor stations in Georgia

to increase the overall capacity to

23 billion m

3

/yr.

10

TANAP is now being constructed. It is one

of the longest pipeline projects in the world

at over 1841 km in length, 56 in. diameter

and 16 billion m

3

/yr capacity, with a planned

expansion to 31 billion m

3

/yr. The ground-

breaking ceremony for TANAP – the longest

and most expensive element of the Southern Gas Corridor

– in the city of Kars north-east of Turkey in March this

year, marked a major milestone in the Southern Gas

Corridor’s development.

The impressive, US$10 billion pipeline,

11

which includes

a Marmara sea crossing section as well as multiple

compressor stations, will cross the whole country from

east to west, traversing 20 provinces, 67 districts and nearly

600 villages and mountains up to 2800 m above sea level.

TANAP is being developed by a consortium consisting of

SOCAR, BOTAS, and BP. ILF Consulting Engineers, a German

engineering consultant with 35 years of project history in

Turkey was awarded the Project Management and Owner’s

Engineering (PMOE) contract in the initial phases of the

project and now continues to support the integrated

management team of TANAP, while an EPCM contract was

awarded to WorleyParsons Resources and Energy, London.

Turkey will receive 6 billion m

3

/yr from TANAP.

Starting at the border to Greece, TAP will transport the

remaining 10 billion m

3

/yr, which is destined for Europe

across 870 km via Albania and the Adriatic Sea to Italy.

According to the Front-End Engineering Design (FEED) for

the pipeline, which was completed by ILF in 2012, phase

one of TAP will have a capacity of 10 billion m

3

/ yr.

However, the pipeline system is designed so that its

capacity can be doubled to 20 billion m

3

/yr in a potential

phase two.

By the end of 2015, major procurement contracts will

be awarded. With the Italian government having signed its

final approval, the construction of the pipeline is expected

to start in 2016. First gas is expected to be delivered in

2020.

12

TAP was preferred as the western extension by the

TANAP shareholders over the Nabucco West project,

which was designed to cross Bulgaria, Romania, and

Hungary and to finish in Austria. TAP joint venture’s

shareholders are BP (20%), SOCAR (20%), Statoil (20%),

Fluxys (19%), Enagás (16%) and Axpo (5%).

Figure 2.

EU gas supply in 2014.

26

World Pipelines

/

AUGUST 2015