World news

8 |

Oilfield Technology

June

2015

June 2015

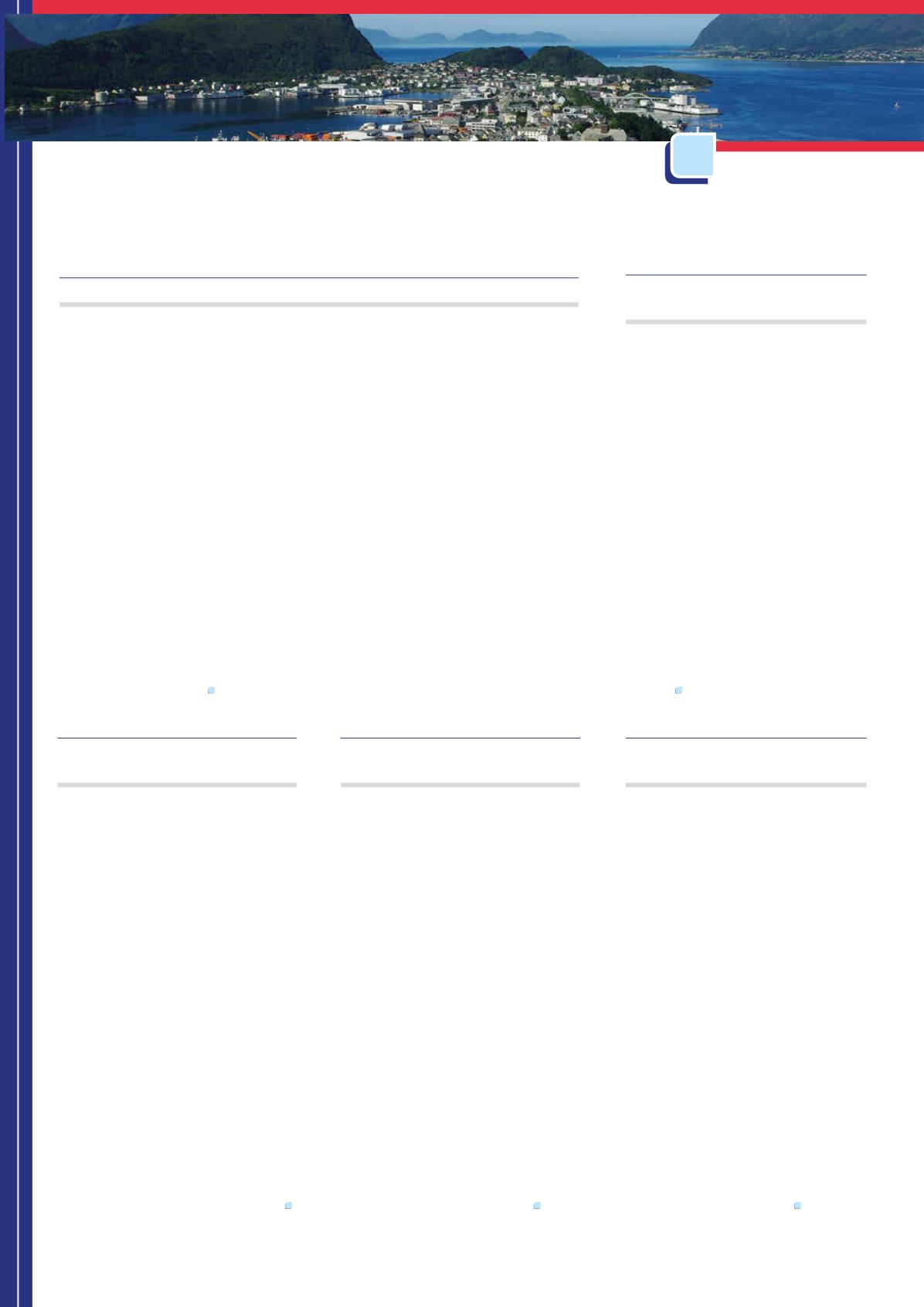

Faroe petroleum announces Bister well results

Faroe Petroleum, the independent oil and gas company focusing principally on exploration,

appraisal and production opportunities in Norway and the UK, has announced that drilling

has reached target depth on the Statoil operated Bister exploration well in the Norwegian Sea

(Faroe 7.5%).

The Bister exploration well 6407/8‑7 spudded on 27 April 2015 and reached total vertical

depth of 2990 m below sea level in the Åre Jurassic formation. This was followed by side‑track

6407/8‑7A which was drilled to a total vertical depth of 2770 m below sea level. The well and

side‑track targeted hydrocarbons in the Jurassic, Ile, Tilje and Åre formations (analogous to

the Hyme oilfield and Snilehorn reservoirs) and whilst good quality reservoirs were confirmed,

no hydrocarbons were encountered at this location.

The Bister prospect is located in the Norwegian Sea in Licence PL 348/C, which is adjacent

to the 2013 Snilehorn discovery (PL 348B) and nearby the producing Njord field and Hyme

field (PL 348) (all Faroe 7.5%) and the results from the well will be used to calibrate the

seismic interpretations in the licence, which still contains promising exploration targets.

Statoil Petroleum AS is the operator of the PL348 licences and the Njord field.

The Bister well was operated by Statoil (35%) using the Transocean Spitsbergen drilling

rig with partners GDF SUEZ E&P Norge AS (15%), E.ON E&P Norge AS (17.5%), Core Energy AS

(22.5%) and VNG Norge AS (2.5%) and will now be plugged and abandoned as planned.

Graham Stewart, Chief Executive of Faroe Petroleum commented: “Whilst the results for the

Bister exploration well are disappointing, this was an opportunity to add further resources to

an already resource rich licence, which includes the producing Hyme field and the significant

2013 Snilehorn discovery.”

FEI & Weatherford enter

joint agreement

FEI and Weatherford Laboratories have

entered into a joint agreement to offer

advanced reservoir characterisation

services to the oil and gas industry. The

two companies will work together to

create new workflows that integrate

Weatherford’s traditional core analysis and

FEI’s digital rock imaging, modelling and

interpretation.

These integrated solutions will address

challenges associated with enhanced

recovery, formation damage, multi‑phase

fluid property prediction and wettability

characterisation.

Mark Knackstedt PhD, Director of

Product Development for FEI’s oil and gas

business, commented on the deal: “By

combining the results, we should improve

reservoir characterisation and help

operators understand reservoir behaviour

and recovery mechanisms – ultimately

reducing their risk and increasing

their ability to make better informed

development and production decisions.”

Wintershall: Maria field

PDO submitted

Wintershall has submitted a plan for

development and operation (PDO) for

the Maria field in the Norwegian Sea to

the Norwegian Ministry of Petroleum and

Energy. This is the first time Wintershall, as

operator of the field, has submitted a PDO

for a Norwegian development.

The solution for the Maria field

involves two subsea templates located on

the ocean floor tied back to several host

platforms in the area.

“By applying this [...] solution we

make the development and production of

the field possible – even in a challenging

oil price environment. We are continuing

to invest in profitable projects in our

core business and core areas”, said

Martin Bachmann, Member of the Board of

Executive Directors.

Investments in the Maria development

are estimated at around NOK 15.3 billion

(100%), including development drilling.

Recoverable reserves on the field are

estimated around 180 million boe.

Roxi Petroleum continues

sale of Galaz assets

Roxi Petroleum, the Central Asian

oil and gas company with a focus on

Kazakhstan, has announced that the sale

of the its equity and debt interests in

the Galaz Contract Area to a consortium

led by Xinjiang Zhundong Petroleum

Technology Co., a Chinese publicly traded

conglomerate, is proceeding as planned

and is now expected to complete by

31 May 2015.

Following the recent rise in the price

of Brent crude, the total proceeds of Galaz

Disposal will now be US$100 million and

the net proceeds attributable to Roxi will

now be approximately US$23 million.

US$2 million of the aggregate purchase

consideration will be retained by the

purchaser for a period of 12 months to

cover warranty claims individually greater

than US$50 000. Roxi’s share of this

retention will be US$0.68 million.

The proceeds of the Galaz Disposal will

fund all of the planned development in

2015 at its flagship asset BNG.

Jee secures contract for

EOR project

Jee Ltd has been awarded a contract from

Amec Foster Wheeler for the front end

engineering design (FEED) of a jacket rigid

polymer injection riser package (including

J‑tubes) as part of an enhanced oil

recovery (EOR) field development.

The pilot project will demonstrate

the use of polymer chemical injection

technology, a pioneering new technique

to maximise the economic recovery of

UK hydrocarbon reserves. A new platform

development for EOR is a world first.

The project will utilise ground‑breaking

technologies including 4D seismic imaging,

horizontal drilling and pump technology.

Development drilling is expected to take

place from 2015 until 2020.

Jonathan McGregor, Head of

Engineering at Jee, said: “We are delighted

to support this pioneering North Sea pilot

project.”