most of the large coal-producing

counties are reporting unemployment

rates of greater than 11%, with

Mingo County and McDowell County

reporting the highest rates of 13.3% and

15.3% respectively.

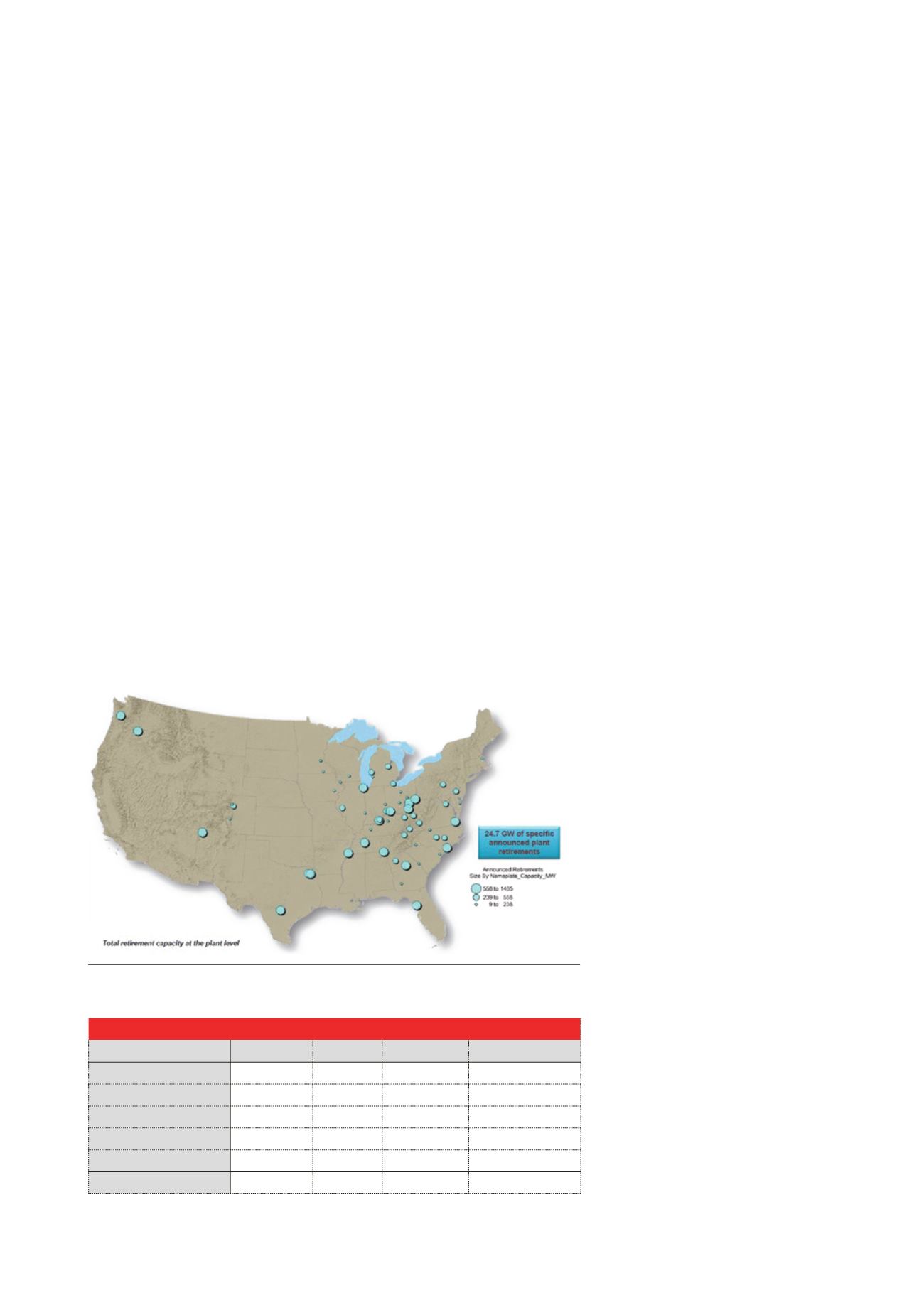

Causes for the recent

downturn

The decline of the state’s coal industry

can be attributed to one primary factor:

the federal regulatory assault known as

the Obama War on Coal. The direct

impact of this regulatory assault has

come with the shuttering of hundreds of

coal-fired power plants across the

country, with many of the closures

coming in areas traditionally served by

West Virginia coal (Figure 1). Each of the

dots on the map indicates power plants

closed or to be closed as a result of the

administration’s regulatory assault on

coal. (Note: The larger the circle, the

more kWh of electricity production is

being retired).

Historically, approximately 60% of

West Virginia’s coal production has been

thermal coal for use in electric

production. The other 40% has been

higher quality metallurgical coal used in

the making of steel. Given that the

majority of coal-fired power plant

closures are in historic markets for

West Virginia’s coal, the impact on coal

production in the state is magnified.

It is important to note that

West Virginia’s metallurgical coal is the

best quality in the world and there is no

real replacement for coal in the

steelmaking process, so that portion of

the state’s coal market is secure except

for the normal cyclical economic factors

that are being experienced today with

the ongoing sluggishness of the world

economy.

While the impact of regulations being

imposed by the Obama Administration

are the primary cause of the decline in

West Virginia coal production, there are

several other factors that are

exacerbating the current downturn.

These factors include:

n

n

An increasingly difficult and

expensive-to-mine reserve base.

n

n

Competition from artificially

low‑priced natural gas.

n

n

Aworldwide decline in demand for

metallurgical coal as a result of a

faltering world economy.

n

n

Recent declines in exports of

thermal coal.

n

n

Competition from other coal

producing regions.

Increasingly

difficult‑to‑mine and

expensive reserve base

Coal has been mined in West Virginia

since before the Civil War and mined on

an industrial scale since just before the

turn of the 20

th

Century. During the past

130 yr, about 2.2 billion t have been

produced in West Virginia’s coal mines.

The state has about 51 billion t of proven

recoverable reserves remaining;

however, much of the low-cost, larger

seam coal has been mined.

This does not mean that, as is often

reported or implied in the media,

West Virginia’s reserve base is ‘rapidly

declining’. What it does mean is that to

remain competitive, the industry will

have to find ways to lower the cost of

mining through innovations in

technology, improved productivity and

reductions in expenses.

To use an analogy, 20 yr ago most

experts considered most of the eastern

gas fields to be depleted. With the

advent of horizontal drilling, deep-well

drilling and fracking, those same fields

are now among the nation’s most

productive.

Competition from

natural gas

West Virginia’s coal industry does face

major competition from the increased

availability of low-priced natural gas.

However, contrary to the popular

perception, natural gas is not cheaper

than coal, even at today’s unsustainably

low prices. In fact, the primary factor

driving the switch by utilities to natural

gas is not price but is rather the need to

find an alternative fuel for baseload

generators in light of the regulatory

burden placed on domestic coal.

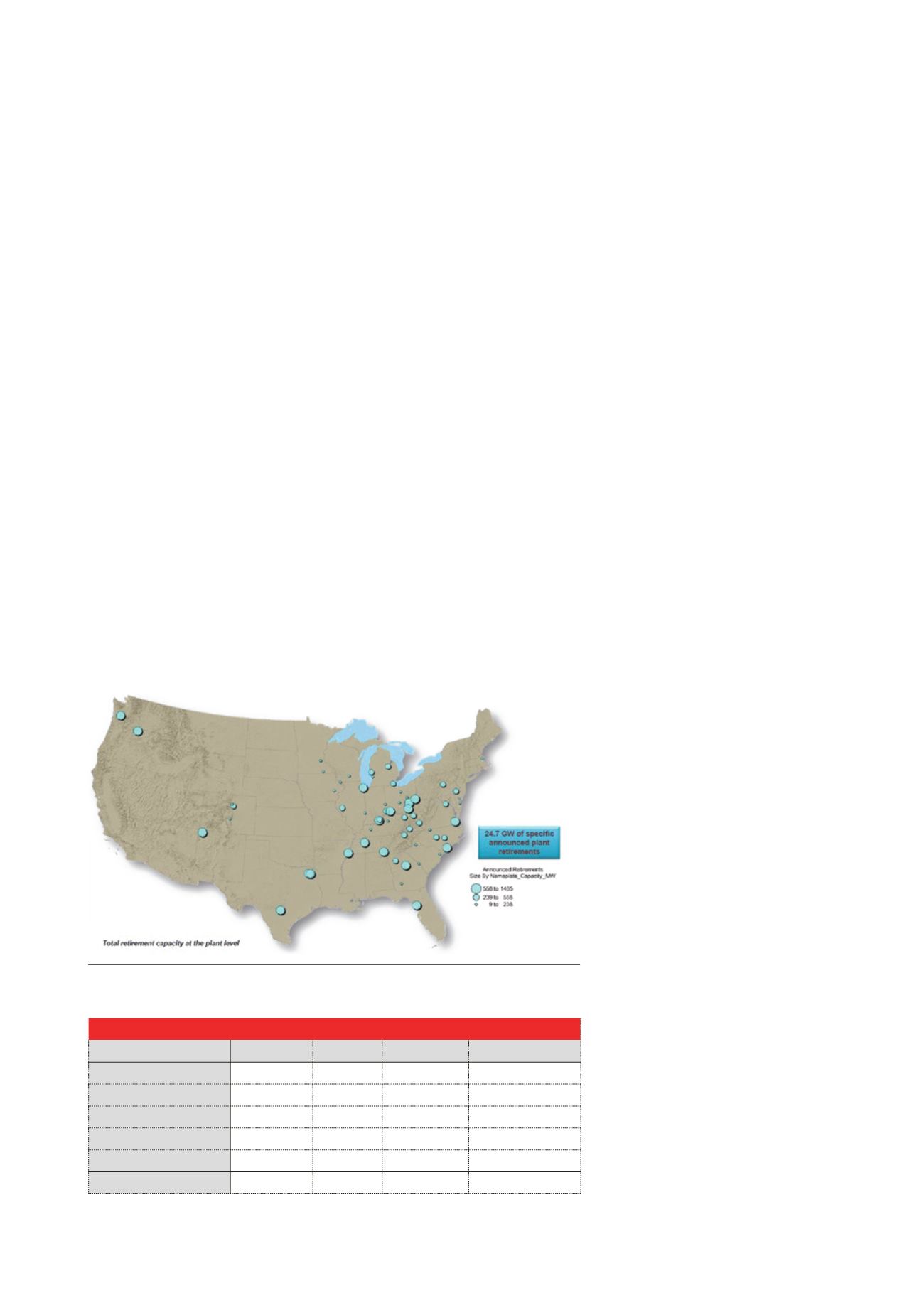

Table 1 shows the current

comparative prices of the major coal

markets compared with natural gas and

each other. The prices reflected are for

the week of 7 May 2015.

The table shows that natural gas

prices, as determined by the spot market

price on the Henry Hub, versus the

Figure 1. Announced coal-fired retirements (2012 – 2020).

Source: National Energy Technology Laboratory.

Table 1. Coal characteristics by coal-producing region

Region

Average Btu SO

2

Price

Price/ million Btu

Central Appalachia

12 500

1.2

US$52.85

US$2.11

Northern Appalachia

13 00

3

US$60.90

US$2.34

Illinois Basin

11 800

5

US$40.45

US$1.71

Powder River Basin

8800

0.8

US$11.55

US$0.66

Uinta Basin

11 700

0.8

US$39.30

US$1.68

Natural Gas (Henry Hub)

n/a

0.01

n/a

US$2.72

14

|

World Coal

|

July 2015